As the 3rd edition of the World Observatory on Subnational Government Finance and Investment report published in October 2022 by the OECD and UCLG shows, many countries are still facing the consequences of the crisis due to the COVID-19 pandemic. To that regard, the whole-of-government approach that was adopted in the Philippines to coordinate responsibilities across levels of government is an interesting case study. It allows to understand the role that local and regional governments can play to address their communities’ expectations as well as the conditions they need to be able to guarantee quality services. The lessons learned from the financial management and governance of the COVID-19 pandemic are bases to improve on and build resilience to crises.

On 7 December 2022, the UCLG World Secretariat organized a webinar on “Inclusive Local Finance in Times of Economic Downturn and Crisis” in the framework of the Decentralization and Local Governance (DeLoG) Network Knowledge and Dialogue Days, to discuss and put forth collaboration opportunities among stakeholders with a decision-making or supporting role to play in subnational government finances.

It is undeniable that local and regional governments are key actors to design solutions during crises and to plan for resilient strategies in the face of long-term inclusive development and recovery. However, local and regional governments cannot act alone, as they work within a national legislative framework, in a complex multi-stakeholder environment and in accordance to the needs of their inhabitants. The webinar focused on the country case of the Philippines, where the decentralized structure is divided into four tiers of subnational governments with the barangays as the level closest to the ground, municipalities, cities and provinces. This webinar brought different stakeholders together to discuss the priority actions to invest in for a positive change in the local finance structure and trends in the Philippines.

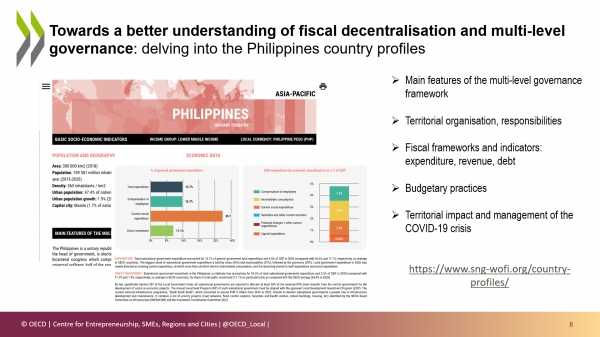

Based on the World Observatory on Subnational Government Finance and Investment, also known as SNG WOFI, Charlotte Lafitte, Policy Analyst of the Center for Entrepreneurship, SMEs, regions and cities of the OECD, set the scene for the conversation and presented the overall trends of decentralization and the state of subnational government finance in the region. The SNG WOFI’s 3rd edition reveals that decentralization reforms in Asia and the Pacific have progressed overall, strengthening the role and responsibilities of regional levels of government. Although subnational government expenditure stands at 29% of total public expenditure in the region, a high share compared to the world average, the figure hides spending obligations that are sometimes determined at the national level. These findings help formulate recommendations for strengthening the effective ability of local and regional governments to raise own-source revenues and diversify their basket of revenues.

The contribution of Veronica Hitosis, Executive Director of the League of Cities of the Philippines, gave an insight into the common challenges faced by local governments during the pandemic. Although their finances were under restrain, local governments could optimize the use of their resources during the pandemic due to the temporary lifting of some fiscal rules by the national government. Possible ways forward to unlock bottlenecks for more inclusive local finance models include stabilizing such temporary measures and establishing a more flexible credit financing framework. This would give local governments more options to spend resources on needed services for their population or hire additional employees in critical sectors. As the caretakers of workers and inhabitants of their community, local and regional governments are ready to respond to crises on their own initiative but they must be enabled to act when needed.

Adding on to the governmental perspective, the Director of the Local Government Units Operations Service of the Bureau of Local Government Finance, Ricardo L. Bobis Jr, started by recalling figures regarding the fiscal performance of local governments, whereby the pre-pandemic high and sustained average growth of own-source revenues collected at the local level fell to a 1% growth rate in 2021. The overarching supporting and coordinating role of the national Department of Finance of the Republic of the Philippines is multifaceted and aims to ensure that national and local public financial management tools and policies complement each other. Their numerous initiatives include offering integrated financial tools to local governments and a scorecard for rating fiscal sustainability, as well as training programs to promote the professionalization of local treasury officers. As fiscal decentralization is a long and evolving process, coming reforms must use verified data and analyses to ensure accountable planning and operations.

In response, Milwida “Nene” Guevara, President and CEO of Synergeia opened the second set of interventions to share an external and partner perspective from the point of view of a non-governmental organization focused on promoting the delivery of high-quality education to children through multi-stakeholder alliances. Having worked in the national government during the first decentralization process, “Nene” Guevara recalled that in the Philippines, like in many countries, revenues do not match devolved responsibilities and resources are insufficient for the adequate delivery of basic public services provided by local governments. To compensate part of these financial and governance gaps, it is crucial to strengthen partnerships between local government units and civil society organizations. These non-governmental intermediaries enable and facilitate the participation of the community in planning activities, promote compliant tax paying, the understanding local government budgets and even direct mobilization of the population to contribute to the budget in creative ways, due to the incentive of seeing the benefits of services that result from taxes. Diaspora bonds are another financial mechanism that is being explored to connect overseas migrants that wish to contribute and invest for the development of their hometown communities.

Pulling together the previous contributions, Rachana Shrestha, Public Management Specialist at the Asian Development Bank (ADB), closed the round of interventions from the panel with a regional vision, where programmes are principally carried out at country level but some actions are directed at subnational governments. According to the public mandate of this multilateral development bank; to alleviate poverty in developing economies, it is acknowledged that reforms should be implemented at all levels of governments, including the local level. The potential, creativity and mobilization capacity of the community by local governments must be unlocked and fostered to address development problems, financial management, service delivery or project formulation constraints.

Hosted by Christian Luy from the DeLoG Secretariat and moderated by Paloma Labbé from the UCLG World Secretariat, this meeting contributed to build a common understanding of the overall local finance situation in the Philippines and for relevant and complementary actors from the field to get better acquainted of each other’s respective priorities and needs. Such multi-stakeholder dialogues based on evidence and reliable information aim to promote joint efforts to reinforce subnational finance in the long-run. In the face of future crises, the involvement of all stakeholders and the promotion of multilevel governance are necessary to build an inclusive environment with a legal basis and partnerships that allow subnational government finance to be resilient. Enhancement of locally-sourced revenue collection, new possibilities for external financing, regularizing intergovernmental transfers, are among the possibilities to explore for a wider and more inclusive local fiscal space in the Philippines. Through their financial management and budgeting decisions, local authorities also have a crucial role to play in reducing inequalities, helping the most necessitous groups of people and including marginalized voices.